The Bossard Group is a leading global provider of product solutions and services in industrial fastening and assembly technology. More than 1 million items as well as proven expertise in technical consulting and inventory management distinguishes the Bossard Group.

Bossard was founded in Zug in 1831. Today local and multinational companies count on Bossard’s expertise to increase their productivity – with success. Bossard calls this concept, which is also a promise to its customers, “Proven Productivity.” This includes, among other things, optimizing processes and reducing inventories to increase the efficiency and productivity sustainably. In addition, Bossard is considered a pioneer in developing intelligent production facilities in line with Industry 4.0.

It can hardly get more boring than that - fasteners and screws …

The modus operandi of Bossard:

Bossard doesn’t just sell screws — it integrates itself into its clients’ production systems. Its Smart Factory Logistics (e.g., SmartBin, SmartLabel, Last Mile Management) becomes part of a customer’s shop floor or warehouse.

Think “C-part control towers” embedded within global OEMs.

This creates switching costs, operational lock-in, and long relationships.

Bossard:

Does not own factories (except small specialty holdings)

Does not produce fasteners at scale

Does not hold excessive inventory

Instead, it earns margins by:

Optimizing industrial supply chains

Reducing downtime for customers

Offering just-in-time replenishment and engineering support

It is a lean enabler of industry—not a factory, but a nervous system.

Bossard offers a consulting-like layer:

Helps clients design fastening systems

Runs pre-assembly simulations

Reduces design-to-market time

This value-added layer strengthens client retention and elevates margins.

Controlled by the Bossard family via Kolin Holding for over 190 years

Strategic decisions prioritize continuity over short-term growth

Acquisitions are surgical and integration-focused:

Major Acquisitions (2003–2025)

1. HI‑Tec Fasteners ApS (Denmark)

Jan 1, 2004 – Acquisition of a Danish fastener trading business, reinforcing Nordic presence

2. Sal‑Pol Sp. z o.o. (Poland)

Sept 1, 2005 – Entry into Eastern Europe via acquisition of a Polish fastener firm

3. KVT‑Fastening (Koenig Group, CH/DE/AT/CEE)

Nov 30, 2012 – Major addition with ~CHF 120 million sales and 230 employees; boosted German‑speaking presence

4. Bruma Schraub‑ und Drehtechnik GmbH (Germany)

Feb 18, 2019 – Small engineering bolt specialist acquired to strengthen German engineering offering (~€11 million sales)

5. Boysen Aerospace / SACS Boysen Distribution (Germany/Europe)

June 24, 2019 – Expanded aerospace business under Bossard Aerospace umbrella

6. Torp Fasteners (Norway)

Early 2020 – Bossard increased stake from 60% to 100%, completing control over Norwegian fastener specialist

7. MultiMaterial‑Welding GmbH (Germany)

Dec 2020 – Investment in additive/lightweight fastening tech with strategic stake

8. Jeveka B.V. (Netherlands/Benelux)

Oct 25, 2021 – Strengthened Dutch/Benelux market with technical wholesale distributor (~100,000 products)

9. PennEngineering Distribution (Canada)

Nov 2022 (completed Dec 1) – Acquired Canadian distribution arm for ~USD 25 million in sales

10. Dejond Fastening NV (Belgium)

July 10, 2024 – Acquired specialist blind‑rivet nut manufacturer (~Tubtara brand)

11. Aero Negoce International SAS (France/USA/Malaysia)

Announced July 2024; completed Sept 26, 2024 – Added aerospace distributor with ~€25 million sales

12. Ferdinand Gross Group (Germany/Eastern Europe)

Announced Oct 15, 2024; closed Jan 7, 2025 – German distributor with ~€80 million sales and 260 employees

For a company which uses M&A as a growth engine the corporate culture is extremely important. To assimilate different teams from different companies is a difficult and risky endeavor. Great effort is needed from top management to assure the alignment of values and guiding principles. I like the emphasis and efforts the members of the Bossard family are putting into that process:

Bossard does not chase technology trends or consumer hype. Its products are evergreen: screws, bolts, rivets, fasteners—used in:

Aerospace

Automotive

Robotics

Wind turbines

Railways

Medical devices

Agriculture

This sector neutrality gives the firm anti-fragile qualities across economic cycles.

Minimal marketing

No capital waste

Long product lifecycles

Sober Swiss governance

It is a firm that creates no noise but enables movement—philosophically aligned with the Calvinist virtue of humble usefulness.

Bossard is a capital-light, deeply embedded, multi-generational provider of fastening intelligence and supply chain continuity—earning durable returns through discretion, discipline, and functional indispensability.

I thought a lot about the business model of Bossard and it looked very similar to Robertet business model in the fragrance industry. Bossard is to industry what Robertet is to sensorial chemistry. Both are high-value, expert-led intermediaries that combine supply chain precision, custom R&D, and long-term integration into client operations.

1. Product + Service Integration

Bossard: Sells fasteners, but wraps them with engineering support and smart logistics systems (e.g. SmartBin).

Robertet: Sells essential oils/flavors, but adds sourcing expertise, custom formulation, and regulatory support.

➡ Both are not just product vendors — they embed themselves in their client’s operations through deep technical involvement.

2. Bespoke & High-Margin Solutions

Bossard: Develops custom-engineered components and consults on assembly optimization.

Robertet: Creates tailor-made fragrances or flavor bases for global brands.

➡ Both drive higher margins and customer loyalty through customization and co-development.

3. Supply Chain Mastery

Bossard: Optimizes factory-level inventory via automated systems (IoT-driven replenishment).

Robertet: Manages complex, traceable agricultural supply chains (e.g., sourcing roses from Grasse, vanilla from Madagascar).

➡ Both excel in upstream integration and logistics precision.

4. Client Stickiness & Long-Term Contracts

Bossard: Clients are locked into logistics platforms and engineering workflows.

Robertet: Clients rely on signature scents/flavors and long-term sensory consistency.

➡ Shared trait: Hard to switch vendors without operational or brand disruption.

5. Deep Technical Expertise

Bossard: Assembly Technology Experts guide industrial design and screw choices.

Robertet: Perfumers, flavorists, and botanists guide product creation with scientific precision.

➡ Both rely on intangible know-how as a strategic asset.

Financial performance:

It will be fair to say that a normalized EBIT of 100 million CHF is achievable and the operating margin of 10% is pretty consistent.

Returns on capital are strong. The return on assets is close to 10% which is a very strong number. ROE is running close to 20%. The capital light model is visible in the numbers - with an EBIT margin of 10% the company is able to perform at 20% ROE, that means efficient assets / Sales/Assets ratio and some leverage.

source: gurufocus.com

With close to 1.19x asset turnover ratio which is boosting the net margin of 7.34% to 8.73% return on assets (approx.). The equity multiplier is 2.21 but this is calculated as total assets/total equity, meaning all liabilities are accounted for not only interest bearing.

I like this business model, but take in mind that each modus operandi has its weaknesses. As the biggest weakness I see the working capital requirements. Yes the business is CAPEX light but a significant inventory should be available and attractive credit terms should be provided to clients. Your suppliers are critical so you should have more aggressive payables policy.

So we sell and collect receivables after 60 days on average but we pay in 30 days to our suppliers. At the same time we turn inventory in around 200 days.

For perspective I want to show you that money tied to inventory is more than money tied in PP&E.

I personally think that the receivables - payables dynamics is a potential field for optimization - decrease credit term for sales and renegotiate credit terms for payments.

Accounting specific section:

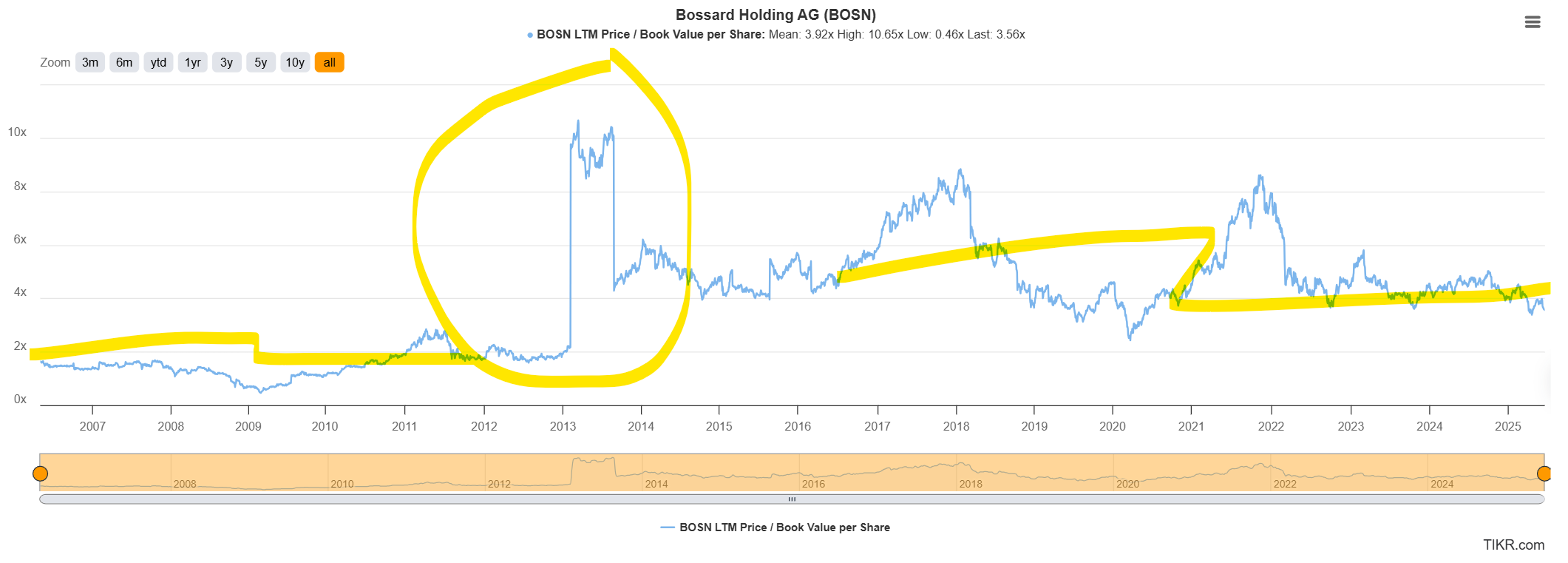

When I was analyzing the company I disliked the higher P/B ratio and dig some more into the matter.

The company was traded around 2x book value and in 2013-2014 something happened and after the spike the normalized P/B is around 4x book value. That raised questions in my head.

Where did the book value per share go in 2012-2013?

I looked at the goodwill and the impairment section as my first assumption. After all the company was driving the M&A engine for growth so I thought they impaired the goodwill and decapitalized the balance sheet. But there was no goodwill at all?

And then it hit me, the company was reporting under Swiss GAAP and not under IFRS :)

Under Swiss GAAP FER, companies can:

Capitalize goodwill and amortize it over its useful life (typically 5–20 years), or

Offset it against equity at the acquisition date.

Bossard chose option 2, which:

Prevented depreciation of earnings in future years.

Created a sudden drop in the equity ratio.

Preserved future income statements from amortization drag, at the cost of lower visible equity.

So the shrink of equity is an accounting double book entry and nor an economic/business event.

In 2012 $BOSN.SW acquired KVT with a 180 million CHF goodwill which was offset directly to equity and that caused the reduction of TOTAL EQUITY.

If we add back those 180 million CHF to equity (assuming, no impairment occurred) we will have additional 23.3 CHF book value per share or a total book value per share of 72.89 CHF.

Valuation:

If use the adjusted book value per share of 72.89 CHF

Cost of equity of 10%

RoE 20%

growth 5%

IV = 72.89 + 72.89*(20%-10%)/(10%-5%)

IV = 218.67

Current price = 174.6 CHF

Margin of safety = 25%

I started a 6% position.

PS: This writeup is a personal opinion and not an investment advice. Do your own due diligence.

Thanks for the write-up. Have you looked at Swiss player SFS, too ? I think their businesses at least overlap to some extent (Fastening, Hoffmann).