FUCHS SE - $FPE.DE - The independent King of friction reduction

Lubricants are to the machine body what synovial fluid and sebum are for the human body - can not go without it.

INDEX:

I. Common Good as an end

II. Ownership - The Fuchs Family

III. Nature and type of business

IV. Business analysis

V. Financial analysis - P&L + Balance sheet + Cash flow

VI. Valuation

I. Common Good as an end

Before continuing with analysis and eventually allocating capital I want to make sure that the business is working toward a common good end. When I was younger I thought this approach was hypocritical and ineffective but with time (most recently actually) I am convinced (for myself) that this is the right way to do investing.

So my first litmus test: Is the business working toward the bonum commune (common good)?

Question

Whether this business, by its nature and operations, works toward the common good in accordance with right reason and natural law?

1. The Objections (Potential Moral Failings)

Before answering, we list possible reasons why it might fail the test:

It produces goods or services that are intrinsically harmful (vice, fraud, exploitation).

It primarily serves disordered consumption without proportionate social benefit.

Its operations destroy or exploit resources in a way that undermines future generations.

It undermines the dignity of labor, treating people purely as costs to be minimized.

2. The Responsio (Core Principle)

A business works toward the common good if:

Its primary outputs are genuinely useful for sustaining or improving human life, productivity, or stewardship of creation.

Its end is proportioned — it neither hoards resources for the few nor squanders them in wasteful excess, but distributes them according to justice and equity.

Its means are morally licit—achieved without fraud, coercion, or intrinsic evil.

Its continuity serves society — it contributes to stable livelihoods, reliable goods, and enduring structures that future generations can inherit.

3. The Criteria

When applying the litmus test, we ask:

Purpose Test – Does the company produce goods or services that directly or indirectly improve the capacity of society to flourish (health, shelter, infrastructure, knowledge, productivity)?

Justice Test – Are the profits earned without exploitation, deception, or the degradation of human dignity?

Stewardship Test – Does the company safeguard the material, environmental, and cultural resources it depends on for future generations?

Restraint Test – Is the business moderate in its aims, avoiding both reckless expansion and miserly hoarding?

Continuity Test – Does the business strengthen the fabric of society over the long term, or is it extractive and short-lived?

“Omne agens agit propter finem” – Every agent acts for an end.

Therefore, we must first determine whether the end of this business aligns with right reason, the common good, and the natural law.

How FUCHS SE is placed into this framework?:

Rating (1–10)

Purpose:

Lubricants prolong machinery life

Rating: 9

Enables productive work

Justice:

Fair supplier terms, transparent pricing

Rating 8

No record of systemic abuse

Stewardship:

R&D in biodegradable lubricants

Rating 7

Needs faster transition

Restraint:

Moderate leverage, steady expansion

Rating 9

No empire-building

Continuity:

90 years of operations, family control

Rating 9

Succession in place

1. Purpose Test

Question: Does the company produce goods or services that directly or indirectly improve the capacity of society to flourish?

Evidence: FUCHS produces lubricants and specialty fluids that reduce friction, prolong machinery life, improve efficiency, and prevent breakdowns in industrial, agricultural, and transport systems.

This is an instrumental good that sustains productive activity — analogous to the oil in the lamp that keeps the flame burning for the household.

Rating: 9/10

Strongly aligned with enabling the material foundations of industry and agriculture.

2. Justice Test

Question: Are the profits earned without exploitation, deception, or the degradation of human dignity?

Evidence: German corporate governance standards, transparent public reporting, and long-term family shareholding encourage fair dealing. No major scandals involving fraud or systemic exploitation.

“Commerce is not contrary to virtue if it is conducted for the sustenance of one’s household and the benefit of the community.” The intent appears ordered toward legitimate gain.

Rating: 8/10

While the business model is morally neutral there is some exposure to military applications / but the business is not focused on that specifically, it is more of a secondary order participation - provide lubricants for the machines not producing them.

3. Stewardship Test

Question: Does the company safeguard resources for future generations?

Evidence: Investments in biodegradable lubricants, lower-emission production processes, and circularity initiatives; but still reliant on petrochemical feedstocks.

Prudence dictates preparing for the transition away from finite resources; reliance on oil-derived inputs must be progressively replaced by renewable chemistry to remain fully aligned.

Rating: 7/10

Alignment could be strengthened through faster diversification from petroleum dependency.

4. Restraint Test

Question: Is the business moderate in its aims, avoiding both reckless expansion and miserly hoarding?

Evidence: Conservative balance sheet, disciplined acquisitions, steady dividend policy; avoids over-leverage and speculative ventures.

This reflects temperantia (moderation) in economic action — neither prodigality nor avarice.

Rating: 9/10

Financial conduct is exemplary for an enduring industrial steward.

5. Continuity Test

Question: Does the business strengthen the fabric of society over the long term?

Evidence: Founded in 1931, family-influenced governance, global network, trusted by industrial clients for decades.

The virtue of perseverantia (perseverance) is evident; its history shows stability through multiple economic cycles.

Rating: 9/10

High likelihood of continuity if strategic adaptability to new technologies is maintained.

From that first exercise we have a good feel about the nature of the business, its strengths and its weaknesses.

The number one weakness in my opinion is that its staying power is under attack in the long run. Faster transition to biodegradable lubricants is crucial. Winning a leading position into EV lubricants is crucial.

Invest, but with vigilance. As oil loses its dominion, the wise steward must see to it that the same diligence and virtue are applied to new forms of industrial lubrication and efficiency. The essence of this business is not oil, but the reduction of friction — both in metals and in the machinery of human work.

II. Ownership

FUCHS SE is a German family-controlled company, and it is still largely owned and led by the Fuchs family, particularly Dr. Susanne Fuchs and her brother Stefan Fuchs, who serves as CEO.

The Fuchs family controls nearly 58% of the ordinary shares (as of 31.12.2024), ensuring complete voting control of the company despite being publicly listed; 42% free float.

The preference shares (no voting rights) are also traded on the market and held by institutions and retail investors; 100% free float.

👨👩👧👦 The Fuchs Family:

👤 Rudolf Fuchs (Founder)

Founded the company in 1931 in Mannheim, Germany.

Started by importing high-quality US lubricants (e.g., from Pennsylvania).

Began local production under the brand “RENOLIN,” which still exists today.

👨⚖️ Dr. Manfred Fuchs (Second Generation)

Transformed FUCHS from a domestic operation into a global group in the 1980s and 1990s.

Known for his engineering mindset, international expansion vision, and conservative financial style.

Remained involved well into his 80s, helping maintain the firm’s strategic continuity.

He was a dedicated Catholic, active in philanthropy, and an advocate of long-term family stewardship.

👨💼 Stefan Fuchs (Third Generation, current CEO)

Took over in 2004; has been CEO ever since.

Holds a degree in business administration; seen as a rational, long-term thinker.

Under his leadership, FUCHS:

Deepened global expansion (esp. Asia, US)

Focused on high-margin specialty lubricants

Strongly emphasized sustainability and R&D investment

Avoided debt and retained a net cash position for many years

👩🔬 Dr. Susanne Fuchs (Sister, Biochemist)

Active shareholder but not in management

Strong advocate for R&D, health & safety, and sustainability

Represents the family on supervisory boards and in philanthropic efforts

🏛️ Governance & Stewardship Style

The Fuchs family exemplifies "Rhineland capitalism":

Conservative growth

Long-term orientation

Strong family control with professional governance

Investment in employees, R&D, and continuity rather than aggressive expansion

The family is known to avoid media attention, but they have built a culture of quiet excellence and seems that cherish values such as:

Stewardship over ownership

Frugality and usefulness

Endurance and continuity

Engineering and craft excellence

III. Nature and Type of Business

Business Description:

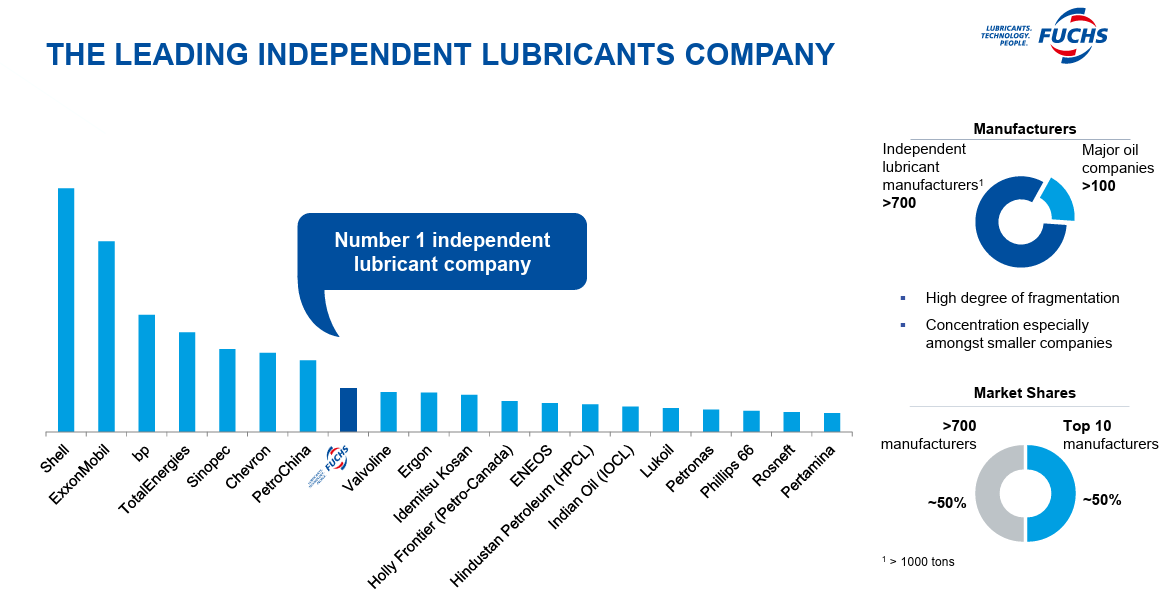

FUCHS SE is the world’s largest independent lubricant manufacturer, founded in 1931 in Mannheim, Germany. It produces a broad range of lubricants, greases, and related specialty fluids serving automotive, industrial, mining, and food-grade applications.

Lubricants, by their essence, are facilitators—they reduce friction, prolong machinery life, and ensure smooth operation of industry. Not an end in themselves but an instrumental good, ordered toward enabling other useful goods to exist and function. This aligns with the virtue of diligence, as it sustains productive work without excess or waste.

2. Moral Legitimacy and Alignment with the Common Good

FUCHS produces goods that are morally neutral yet socially useful, enabling manufacturing, transport, and energy systems to operate efficiently.

It does not primarily serve luxury vanity, speculative finance, or war profiteering, though some products are inevitably used in defense industries (e.g., military vehicles). This indirect participation can be tolerated if the primary end is legitimate industrial support, provided that direct production for unjust war is avoided.

The business provides long-term skilled employment, invests in R&D for cleaner and more sustainable lubricants, and supports environmental stewardship—aligning with the principle of stewardship.

3. Economic Moat

Type:

Product Complexity & Application Know-how: Lubricants are technically sophisticated blends tailored to customer needs, creating high switching costs.

Brand and Trust: Industrial clients rely on proven performance, which in critical applications (aviation, high-performance manufacturing) is a trust-based moat.

Global Service Network: FUCHS has subsidiaries and distribution in over 50 countries, offering localized technical support.

Scale in Procurement & R&D: Being the largest independent player allows R&D investments that smaller rivals cannot match.

The moat is rooted in habitus artis — the acquired habit of excellence in a craft—built through decades of accumulated expertise. This is a just form of advantage, born from diligence rather than manipulation.

4. Endurance & Durability

Historical Record: Nearly a century of operation, surviving world wars, oil crises, and globalization shifts.

Business Model Resilience: Lubricants are a consumable necessity in machinery; demand is tied to the stock of machines in use, not just new production cycles. This makes it less cyclical than industries dependent solely on capital goods orders.

Risks to Endurance:

Electrification may reduce demand for certain automotive lubricants, though industrial uses remain broad.

Regulatory pressure for biodegradable and environmentally friendly lubricants (a risk, but also an opportunity if embraced).

A durable business is like a virtue — it must be adaptable to the mean between excess and deficiency. Continued R&D in green lubricants ensures that the company does not become morally or economically obsolete.

5. Financial Stewardship

Balance Sheet: Conservative financing, historically low leverage.

Capital Allocation: Steady dividends, moderate reinvestment, acquisitions aligned with core competence (not empire-building).

This reflects temperantia (moderation) in financial conduct, avoiding both the vice of prodigality and the vice of avarice.

6. Moat Width & Depth

Width: 8/10 – Broad product portfolio across industries, trusted globally. Switching costs are high in critical applications.

Depth: 7/10 – Defensible expertise and relationships, but vulnerable to disruptive chemistry or technological shifts in engine design.

IV. Business Analysis

source:https://fuchs.azureedge.net/fileadmin/Home/Investor_Relations/Finanzpraesentationen/2025/0608_FSE_Investor_Presentation.pdf

Keep reading with a 7-day free trial

Subscribe to DB_Silver_Fox’s Substack to keep reading this post and get 7 days of free access to the full post archives.