KONE - $KNEBV.HE

KONE is an invisible custodian of vertical life. Its contracts are annuities, its reputation long, its family guardians steady. Exposure to speculative property weakens it, but its service moat endure

Nature of Business

Founded 1910 in Helsinki, still family-controlled (Herlin family, ~62% voting rights).

Core business: elevators, escalators, automatic doors, and building lifecycle services.

Present in over 60 countries, with >60,000 employees.

Business model: new installations (~40% revenue), but moat strength lies in long-term service & maintenance contracts (~40% of revenue) and modernization (~20% of revenue)

source:https://www.kone.com/en/Images/KONE_Annual%20Review_2024_tcm17-134328.pdf

Moat

Width:

Very wide: oligopoly with Otis, Schindler. High barriers to entry (R&D, safety regulation, installed base).

Regulatory entrenchment: certification, safety standards, building codes make switching hard.

Depth:

Deep: once elevators/escalators are installed, service contracts last decades.

Switching costs: building managers rarely change providers, as warranties and technical know-how are tied to original manufacturer.

Weakness: competition for new equipment is price-sensitive, especially in China. Depth lies almost entirely in maintenance recurring cash flows.

Endurance & Cyclicality

Endurance: Very high in services; maintenance and modernization ensure recurring, compounding cash flows.

Cyclicality: New installations are cyclical (linked to construction, especially Chinese property cycle), but maintenance is defensive and sticky.

Long-term secular tailwinds: urbanization, high-rise density, ageing building stock in Europe/North America.

Discretion: KONE is not flashy — it sells trust, safety, reliability. Invisible, but essential infrastructure.

Continuity: Over 100 years, family ownership intact (Herlin dynasty). Governance continuity strongly aligns with Ordo Custodis ethos.

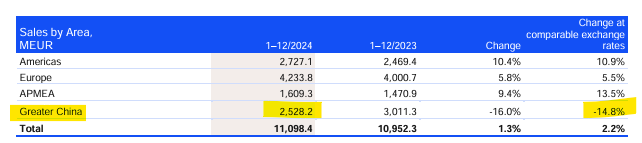

Weakness: Exposure to China’s property cycle (23% of sales in 2024) adds fragility.

source:https://www.kone.com/en/Images/KONE_Annual%20Review_2024_tcm17-134328.pdf

source:https://www.kone.com/en/Images/KONE_Annual%20Review_2024_tcm17-134328.pdf

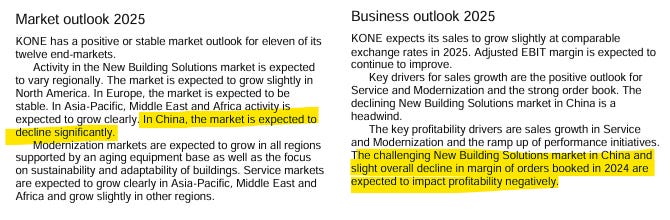

From the 2024 annual report it is clear that all markets are expected to perform with the exception of China where management expects significant declines.

The Herlin Family & KONE

Keep reading with a 7-day free trial

Subscribe to DB_Silver_Fox’s Substack to keep reading this post and get 7 days of free access to the full post archives.