$KWS.DE - KWS SAAT SE & Co. KGaA

He who controls the seed, guards the threshold of tomorrow. Let no generation pass without provisioning the next.

Yes, you saw right, the company is in business since 1856.

🌱 Company Overview

Founded in 1856 by farmer Matthias Christian Rabbethge in Klein Wanzleben for sugar-beet breeding

Today, KWS is one of the world’s largest plant-breeding and seed producers, active in over 70 countries, with approximately €1.7 billion in revenue (2023/24) and about 5,000 employees

The company remains family-controlled and independently run, reflecting over six generations of stewardship

👨👩👧👦 The Controlling Families Explained

✳️ Giesecke‑Büchting Family

Descendants of Matthias Christian Rabbethge, the company's

Andreas Joachim Büchting (b. 1946), an agronomist and crop scientist, served on the board from 1978 to 2007, then moved to Chairman of the Supervisory Board; his academic background includes Cornell and a doctorate from Hohenheim

The family's leadership reflects a blend of scientific breeding expertise and dynastic continuity, embodying generational discipline.

✳️ Arend Oetker Family

Linked to the Oetker industrial dynasty (baking goods, finance, and logistics).

Marie Theres Schnell, Arend Oetker's representative, serves as Deputy Chair of the Supervisory Board, emphasizing the family's long-term growth and independence ethos

✳️ Tessner Family

Holds around 15.4%, likely representing extended family or long-term investors committed to the family-controlled structure. A multichannel furniture retail and real estate family enterprise, primarily in Germany. Notably, the furniture operations became part of Metro Group’s furniture division in 1996.

Current ownership structure:

source:https://mediamaster.kws.com/04_Company/03_Investor_Relations/04_Financial_Report/2024_2025/Q3/2025_05_KWS_InvestorRelations.pdf

We can see that for Büchting and Oetker families the ownership is 53.9% - how is this ownership divided by the two families?

source:https://www.marketscreener.com/quote/stock/KWS-SAAT-SE-CO-KGAA-436539/company-shareholders/?utm_source=chatgpt.com

The company through the lenses of stewardship and generational continuity:

🛡️ $KWS.DE

Guardianship of Seed, Foresight of Nations

🌱 I. Foundational Purpose: Sacred Provisioning

KWS exists to protect and propagate the origins of life—the seed. It views its mission not simply as agriculture or biotech, but as a multigenerational guardianship of plant sovereignty, ecological continuity, and food system integrity.

Seed as sacrament: Every seed is an encoded promise—yield, nourishment, resilience.

Stewardship over dominion: The company cultivates rather than exploits.

🏛️ II. Dynastic Control and Generational Memory

Controlled by the Büchting, Oetker, and Tessner families, with ownership tracing back over six generations to 1856.

KGaA structure ensures voting control remains dynastic and immune to hostile takeovers.

Capital markets are used selectively, never at the cost of familial custodianship.

Continuity is a covenant, not a commercial tactic.

🧬 III. Ethos of Long-Term Agricultural R&D

KWS reinvests roughly 19–20% of revenues into R&D, primarily in plant breeding and seed technology.

Develops resilient crop varieties: sugar beet, corn, wheat, oilseed rape, and vegetables.

Maintains seed banks and genetic diversity: safeguarding agricultural independence.

Focuses on non-GMO and climate-adaptive strains where appropriate.

This long R&D cycle reflects the temporal humility of an institution that thinks in decades and harvests, not quarters.

🌍 IV. Operational Modesty, Global Footprint

While global (present in 70+ countries), KWS maintains a modest public profile:

Products touch all layers of society: farmers, bread makers, families.

Serves both developed and developing economies with regional crop specialization.

Avoids imperial scale in favor of cultural adaptation and local breeder knowledge.

🏗️ V. Moral Capital & Governance Restraint

No speculative financial engineering.

No overleveraged acquisitions.

No activist appeasement.

Instead, KWS upholds:

Financial conservatism

Product integrity over scale

Frugality in management structure

Subsidiarity in governance—decisions often devolve to regional agronomists.

📜 VI. Custodial Creed - Interpretation

He who controls the seed, guards the threshold of tomorrow. Let no generation pass without provisioning the next.

KWS functions as:

The Seed Priest of civilization

The Agronomic Custodian of Europe

A defender of intergenerational trust embedded in agriculture

The business and the structure of the company is very well aligned with my investment philosophy. It can become a core position.

🛡️ SWOT Analysis – $KWS.DE

✅ Strengths

Dynastic Ownership Controlled by Büchting, Oetker, and Tessner families (>70%), ensuring long-term vision, resistance to short-termism, and alignment with legacy capital.

KGaA Legal Structure Protects against hostile takeovers and enshrines family control, allowing multi-generational planning.

High R&D Investment Reinvests ~20% of revenue into breeding and biotechnology—unusual discipline and vision in agriculture.

Core Mission = Provisioning Seeds are foundational to civilization—KWS provides resilient, sovereign plant varieties for global food security.

Diversified Crop Portfolio Corn, sugar beet, wheat, rye, oilseed rape, and vegetables across 70+ countries = diversified agricultural provisioning.

Ethical Capitalism No hype, no excessive executive pay, frugal governance, no financial engineering.

Heritage and Continuity Over 165 years of agricultural focus; 6 generations of stewardship.

⚠️ Weaknesses

Modest Scale vs. Giants Compared to Bayer Crop Science, Corteva, or Syngenta, KWS is small and niche—this may limit pricing power or geopolitical leverage.

R&D-Heavy Cost Base Long innovation cycles and regulatory hurdles can slow returns on capital — 20% R&D is admirable but burdensome / it is a double edged factor. On the positive side it can strengthen the moat, on the negative side it makes the business more capital intensive and has a negative impact on ROIC. Below I will show you how to make adjustments for R&D in order to see the true profitability of the business. It is more economical to look at R&D as an investment and amortize it for a 5 year period than writing it off as incurred.

EU Regulatory Exposure Reliant on European governance; shifts in EU biotech or environmental policy could affect market access.

📈 Opportunities

Climate-Resilient Agriculture KWS can become a leader in drought-resistant, climate-smart crop varieties—key to 21st-century provisioning.

Global South Expansion Growing demand in Africa, Latin America, and Asia for sovereign seed sources independent of agro - conglomerates.

Food Sovereignty Movement Rising concern over seed patenting, GMO control, and national food security may boost demand for independent breeders like KWS.

Soil Health + Regenerative Ag Participating in new soil-friendly farming ecosystems could differentiate KWS vs. extractive players.

AgTech Integration Potential to selectively partner or acquire ag-tech platforms focused on yield, digitization, and data-soil interfaces.

🛑 Threats

GMO and Biotech Backlash Regulatory, legal, or social opposition to seed modification—even non-GMO breeding—may increase compliance burdens.

Geopolitical Seed Nationalism Countries may force local seed sourcing, limit exports, or erect IP barriers in strategic crops.

Climate Volatility Droughts, floods, and pests can affect customer productivity—demand may shift unpredictably.

Agrochemical Conglomerate Power Bayer-Monsanto, Syngenta, and Corteva wield enormous lobbying, scale, and vertical integration.

Consolidation Pressure As the seed industry centralizes, KWS may face pressure to merge or scale in ways that challenge its independent ethos.

🧭 Perspective

$KWS.DE represents one of the purest Saturnian-Stewardship companies in Europe:

Its strengths lie in dynastic permanence, R&D integrity, and moral provisioning.

Its weaknesses reflect EU legislature change risk.

Its opportunities are deeply aligned with future food ethics, sovereignty, and decentralization.

Its threats are structural and ideological—but KWS's fortress-like governance offers real protection.

FINANCIAL ANALYSIS:

Strategic M&A which impacted the overall profile of the company:

There was one big acquisition in 2020 for around 400 million euros, we can see that the company is an organic grower with a very conservative capital structure / negative net debt for most of the time. Because of that acquisition the net debt is around 400 million euros. The company which was acquired is Pop Vriend Seeds (based in Andijk, Netherlands) - its main business is highly specialized in vegetable seed. With this strategic move KWS entered this new market and diversified its profile.

🌍 Strategic Relevance (Post-KWS Acquisition)

Helped KWS diversify beyond arable row crops (corn, sugar beet, wheat).

Opened KWS to the high-margin, short-cycle vegetable segment, especially useful in regions with increasing food security concerns.

Allowed KWS to compete more effectively with vegetable-seed giants like Syngenta, BASF Nunhems, and Rijk Zwaan.

Gave KWS a presence in the health-conscious, fast-growing spinach market—one of the most technically demanding crops for hybrid breeding.

In terms of financial performance (P&L metrics) the company is a real champion. Growing sales, growing profits and growing margins.

This seed business is very resilient. Looking at 2009 results during the great financial crisis, the company was printing money like business as usual.

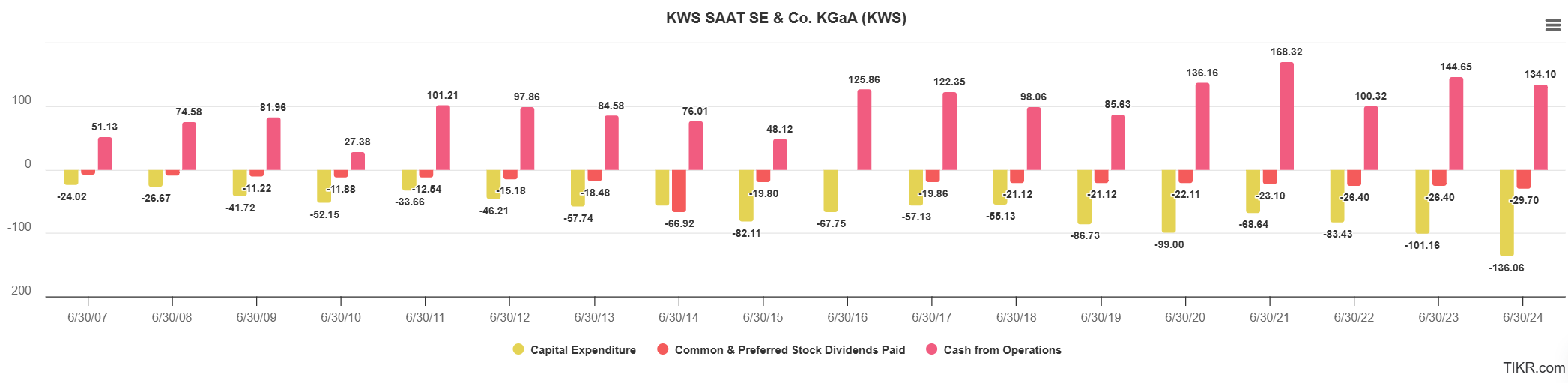

No negative cash flow from operations either.

The company can generate normal cash flow from operations in the 120-130 million euro range.

So most of the CFO is reinvested into the business and around 30 million euros are distributed as dividends. Reinvesting back into the business at 12%-15% return is a smart thing to do.

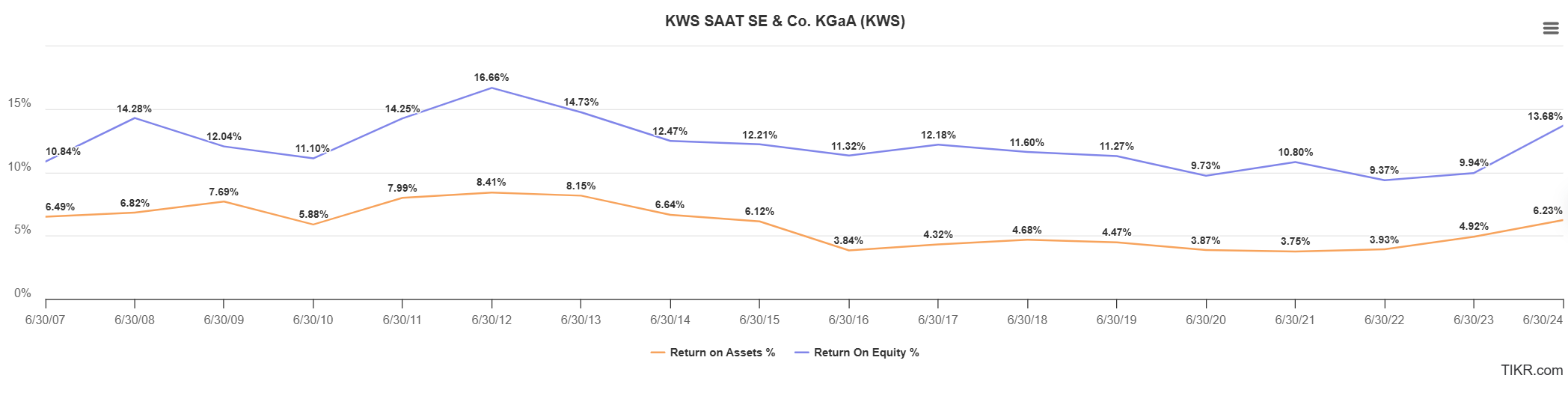

Based on accounting data we can conclude that the normalized return on equity is around 12%, but there is one little detail - if we capitalize R&D and depreciate it in 5 years we will see that accounting profitability is “undervalued” and ROE is “undervalued”.

Here comes the R&D adjustment:

source: own calculations; input numbers from TIKR.com

So I created an amortization table for R&D costs / 5 year useful life. In this manner I state that R&D is more of an investment than an expense.

So you can see that from an average operating margin of 12%, the adjusted operating margin is closer to 15%. I do the same for the net income and with the Du Pont system reconstruct the ROE of the company:

source: own calculations; input data from TIKR.com

Net margin from average of 8% is close to 12% and when multiplied by the asset efficiency ratio and the total leverage ratio we get the ROE. From an average of 11% the adjusted ROE is close to 16%.

Keep reading with a 7-day free trial

Subscribe to DB_Silver_Fox’s Substack to keep reading this post and get 7 days of free access to the full post archives.