Currently my portfolio is concentrated exclusively in Europe. US is also a market of interest for me but at the moment I can find great businesses at attractive valuations outside US. I also don’t like the economic policy of US - playing the bully not only against its enemies but also against its friends. So much for the macro and the politics :)

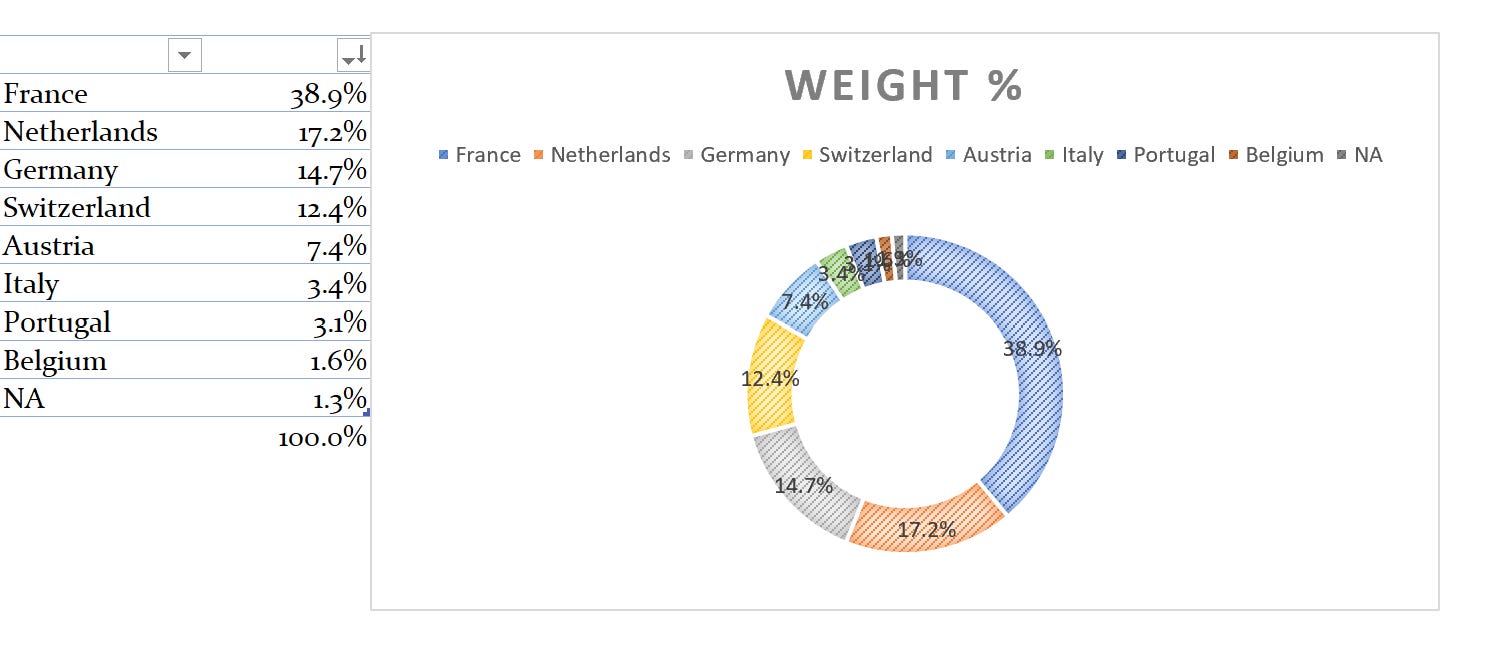

In terms of Geographic allocation:

Almost 40% of my stock portfolio is concentrated in France. I think in the last 3-4 years France managed to become the number 1 power in Europe leaving Germany behind as a number 2 (actually the Germans did that to themselves, but this is another story).

France and Germany were, are and will be the heavy weights of the EU but there are a lot of interesting companies in countries like Italy, Spain, Netherlands, Austria, Belgium, Portugal. Switzerland is a very interesting case with a lot of high quality export oriented businesses and with a very sound currency and politico-economic structure (de-centralized - anti fragile system). It was quite overvalued but with the tariff wars and global headwinds the Swiss stock market has released some hot air.

For a country to be interesting for investing one’s capital there should be several must factors:

Ownership rights are absolute and protected.

The rule of law reigns.

With all its problems I think the major European countries + Switzerland are still one of the best options for investing in public companies and I would also add the Nordic countries (Sweden, Denmark, Norway, Finland). Currently the biggest advantages against US corporations are:

A lot of family owned companies can be found on the European public markets. Nothing can beat the ownership incentive. No manager can be more dedicated and passionate that the owners of the business. I feel much more comfortable with the ownership culture than with the management culture (financial engineering in the toolbox as well).

Valuation. Quality businesses in Europe look cheaper than US peers.

US of course is with the most developed capital markets in the world but a lot of non-sense right now - One of the biggest being the state/the politician clique attacking the FED/central bankers clique and striving for the control of all the levers including the monetary one (a big red flag that should not be underestimated). Those are big structural frictions which should have consequences.

My performance in % terms (returns are in USD currency):

2020: +70.9%

2021: +22.7%

2022: -19.8%

2023: +13.8%

2024: -8.9%

2025 YTD: +13.8%

Keep reading with a 7-day free trial

Subscribe to DB_Silver_Fox’s Substack to keep reading this post and get 7 days of free access to the full post archives.